How an early error in business judgment by the Lakers legend laid the tracks for multiple millionaires and the Swoosh through the ’80s and ’90s.

Money, fame, influence? Earvin “Magic” Johnson has plenty of all three.

In his second act as an entrepreneur, the shogun of Showtime has surpassed his winning ways as a five-time NBA champion to become even more of a behemoth in the boardroom. Valued at an estimated $620 million, Magic’s made the Lakers a global brand, sold shares in Starbucks, and touched lives as an AIDS advocate.

To walk a mile in Magic’s shoes means leaving footprints on sports, business, and entertainment that few can fathom and next to no one could touch.

But what if those shoes were Nike?

Before landing in Los Angeles and becoming a household name, Magic was merely a highly-touted hoop prospect looking to get his feet wet in the endorsement game.

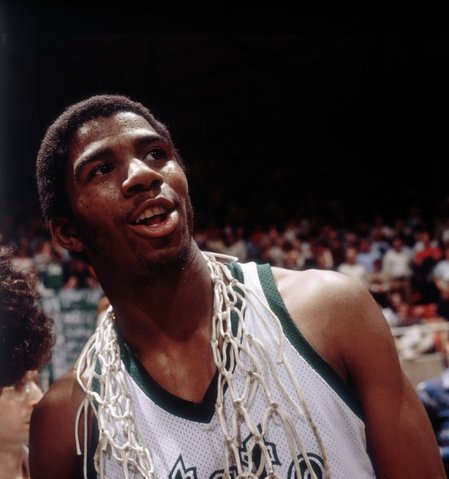

Having just stolen the show in the 1979 NCAA Championship — then the highest-rated hoops game in Nielsen TV history — companies from far and wide were pitching the future mogul on outfitting his size 14 real estate.

“Here I am, just winning a National Championship against Larry Bird,” Johnson recently recalled to All the Smoke. “Three companies came in: Converse, Adidas, and Nike.”

With thousands of dollars at his fingertips and the world literally at his feet, the 19-year-old with three semesters of communications courses had to make a choice: sign with tried and true Converse for $100,000 cash or take an offer from Phil Knight’s upstart sweetened by stock options?

Boardroom breaks down the history of the Hall of Fame icon, the sportswear staples, and the business behind each entity 44 years later.

Coming Out Strong

In the fall season of 1979, Earvin “Magic” Johnson was turning pro while turning 20 years old.

That same year, Converse was turning 90 and was recently acquired by Allied Corporation.

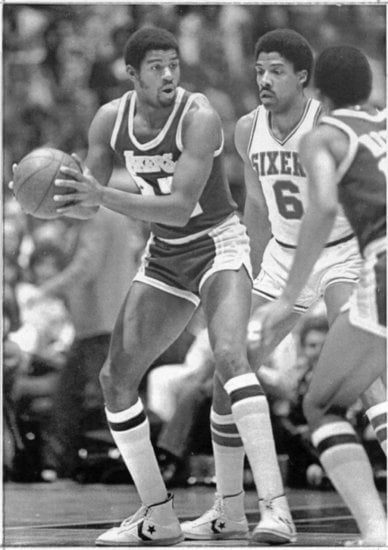

A household name, the Chevron-branded footwear company commonly associated with Chuck Taylor was still a staple where basketball was concerned, worn by top-tier programs like North Carolina and high-flying All-Stars like Julius Erving.

At that time, everyone from Adidas to PUMA to PONY was emerging in the market.

However, for Magic, nobody beat Dr. J and it was almost impossible to top cold, hard cash. Nevertheless, a distance runner-turned-shoe peddler offered Magic an incentivized deal when it came to signing with a start-up.

“Phil Knight came in and said, ‘I can’t offer you the same type of money, but I can offer you stock,'” Johnson recalled on ATS.

Recently, this meeting of the minds was revisited in fictionalized fashion on the HBO series, Winning Time.

In the episode, an actor playing Phil presents the character depicting Johnson with a white/purple Nike Blazer shoe branded with “MAGIC” on the heel. Though the exchange may be dramatized in regard to dialogue, the shoes and numbers align with what would’ve likely taken place in that infamous exchange.

“It’s a fascinating subject,” Winning Time costume designer Emma Potter told Boardroom in 2022.

“That what one person thinks is just a shoe has this story or different meaning to all these other people.”

To sneakerheads, that piece of fictional footwear symbolizes a world where Magic Johnson would’ve graced Peter Moore posters and appeared in advertisements directed by Wieden+Kennedy.

Purple pairs of Force and Flight sneakers would’ve flown across The Forum floor, sold by the man with the million-dollar smile.

However, in 1979, cash on hand meant more than stock options in the future. Just the same, a proven brand was a proven brand.

“Nike was just a year or two old,” Johnson continued. “Converse offered me the most money. When you grow up broke? You take the money.”

As illustrated on Winning Time and on All The Smoke, that same stock Knight offered Johnson in ’79 would now be worth $5.2 billion. For reference, that’s almost enough to buy the Los Angeles Lakers franchise today in straight cash.

Although it was unclear at the time what Nike would one day become, as well as what Adidas initially offered, hindsight is 20/20 and humor abides when one wins and aims high like the prodigal point guard.

Despite the unforeseen fumble at the time, Magic was able to raise the value of his team, his franchise, the league, and his footwear sponsor.

All entities would go through ups and downs over the following decades, but all would end up more intertwined than one could ever believe.

Pros & Cons

When Magic Johnson signed with Converse in 1979 for $100,000 in cash, no one thought it was a bad deal.

In many ways, it wasn’t.

With Magic, Converse aligned with a superstar in a mega-market that was set to revolutionize the league when it came to entertainment and TV money.

While all the Nike stock sure sounds good in 2023, money on hand went much further in the moment for a teenager transplanted to LA.

Upon signing Magic, Converse instantly had a return on its investment.

Magic won Finals MVP as a rookie, placing the future of the brand across the court from its most notable name, Julius Erving.

In that iconic series, Adidas and PONY appeared all over the hallowed hardwood on the likes of Kareem Abdul-Jabbar and Darryl Dawkins. Yet, the game’s megastars were clad in Converse Pro Leathers.

Noticeably absent from the action was Nike. Quickly that would all change.

Over the course of the ’70s and into the early ’80s, Nike was expanding its business from West Coast track disruptor to player in all major sports.

When it came to basketball, it banked on signing rebellious players and coaches that drew so much attention from their flash and their antics that advertising handled itself.

Still, many hoopers proved weary of Nike’s upstart nature and lack of pedigree in hoops. Even worse, many of the game’s most accomplished athletes found the Swoosh logo to be silly.

“I wore the Nike Blazer as a prototype in the ’72 Olympic Games before they brought it to market,” Spencer Haywood told Boardroom in 2021.

Earning equity for his deal with Nike — though tragically seeing the stock sold behind his back by a crooked agent — Haywood took the risk Magic and most weren’t willing to take. He also took the heat.

“Wilt Chamberlain, Jerry West, and Oscar Robertson were all on the team,” Haywood continued. “Wilt said, ‘What are you doing with this shoe? That ain’t nothing but an upside-down Newport!’”

Despite a lack of exposure in the 1980 NBA Finals, the Beaverton brand went ham after missing on Magic, claiming 120 NBA endorsers by the 1982-83 NBA season. This may sound awesome on paper, but it was killing the brand in regard to the bottom line.

According to Swoosh: The Unauthorized Story of Nike, Converse was wiping the floor with Nike at retail despite the Beaverton brand actually having more market share on the court.

Although the Swoosh swelled to outfit almost half the league, it was superstars that sold shoes, not an abundance of bodies. At the same time, Converse crushed competitors off the strength of Magic, Larry, Julius Erving, and Isiah Thomas on its roster.

By 1984, Converse, as a brand, was doing $267 million in sales.

Because of this, Nike spent the next season shedding all of its contracts by paying pro players to walk. It was an asinine attempt to free up cash and cap space to sign a smaller stable of more marketable stars a la Converse.

It worked.

Famously, Nike signed a young lad out of North Carolina named Mike Jordan for $500,000. Not only was this a moonshot in regard to going all-in on unproven talent, but his contract at the time was five times what the Swoosh had been paying Moses Malone, a three-time NBA MVP, Finals MVP, and face of the Air Force 1.

That same summer, the Beaverton brand bet on arriving Auburn forward Charles Barkley to endorse its Force brand. The leftover endorser budget was to be saved for the next draft’s golden goose, Georgetown center Patrick Ewing.

As the man named Magic continued to cash checks from Converse and claim his third NBA Championship, the tide of sportswear was changing before his eyes.

Magic may have had the rings and endorsements on hand, but Nike was beginning to monopolize the feet of the youth.

Red, White, & Green

By the mid-80s, Converse claimed basketball’s best from an All-NBA and NCAA sense.

Heading into the 1985-86 NBA season, its lead was shrinking.

Arriving in the spring of 1985, Michael Jordan’s new Nike Air Jordan shoe was so hot that Magic, Zeke, and even the Swoosh-sponsored George Gervin chose to freeze the rebellious rookie out at the ’85 All-Star Game. Nevertheless, MJ moved over 3 million pairs of his signature shoe after its April ’85 arrival, resulting in a reported $55 million worth of sales.

Even as Air Jordan cooled off in the latter months of ’85, discounted Nikes flooded the market.

“We massively oversold the original Air Jordan,” Dave Siddons, former Nike sales rep told Boardroom in 2022. “The AJ1 was on sale in so many colors.”

Over-saturating the market with MJ made problems for both brands.

Aside from Nike having to reset the Air Jordan line, the oversold original stole market share from Converse, playing a part in the Chevron’s sales dipping $42 million in the span of the year.

By 1986, a group of outside investors and inside management acquired Converse for $100 million. While ownership was changing hands, the strategy was pivoting toward that of Nike and Mike.

Converse caught on to the power of triple-tone sneakers, making Magic a White/Purple-Yellow colorway of the Weapon soon after. Though the Weapon’s aesthetic, sales, and marketing campaign made for a bright spot for Converse basketball in the ’80s, the tide had already changed.

Heading into the next decade, Converse couldn’t create compelling signature shoes for Magic.

While touring the world with the 1992 Dream Team, the situation between Johnson and his shoe sponsor had turned into a nightmare. Hosting a make-shift press conference in Monte Carlo, Magic let it be known that his days with the Chevron would be coming to an end.

“Converse is still living in the 1960s and ’70s,” Johnson said in 1992. “They haven’t arrived in the ’80s and ’90s where advertising and marketing are the keys. Guys like Larry [Bird] and myself can’t take ourselves to the next level.”

While the timing seemed strange, the sentiment was right on.

Across Team USA, the likes of Michael Jordan and Patrick Ewing were selling sneakers of their own namesake to a global audience. At that time, sports footwear was a $12 billion a year business, with Jordan and Ewing — both clients of David Falk — each securing a significant piece.

“The majority of players who have endorsement relationships simply get paid to wear shoes,” David Falk told Boardroom in 2022. “The elite players, since Michael, have their own signature. Patrick actually owned a significant piece of [his own] company.”

Both ballers built their brands on the backs of giants like Magic and Bird, using the massive market the two titans had created to leverage their likeness through sportswear.

Even though Converse had supported Johnson during his diagnosis of AIDS and early philanthropic endeavors, the visions were not aligning.

By 1994, Magic was no longer with Converse as the brand looked to elevate other young stars with the surname Johnson, namely Larry and Kevin. This split meant little to each party at the time, as Magic was retired from hoops.

However, the nuanced narrative of Magic and the footwear industry reemerged shortly after.

In 1996, Magic came back to the Los Angeles Lakers, playing 32 games at the age of 36.

A Groundhog Day debut proved it would not be the same sneaker story again and again as the Laker legend sported his own endeavor: the MVP Point Forward Mid.

Aligning economy-based pricing with a major market, Magic rolled out the aptly-name MVP Return Mid that same season, selling for $59.99 in Eastbay.

All the while, Converse looked to lean into new energy from the likes of Latrell Sprewell, Brevin Knight, and even Master P.

Heading toward the new millennium, Magic’s playing days were behind him, as was his MVP brand.

Nevertheless, Nike remained at the top of the market while Magic remained savvy about all opportunities ahead.

Three Big Banks

In 2003, just 20 years after Dr. J defeated Magic Johnson in the NBA Finals, the state of basketball brands and signature shoe deals took a major shift.

That summer, Nike signed a high school hoops star named LeBron James for $90 million. Upping the ante, the Swoosh also acquired active Laker legend Kobe Bryant for $40 million.

Michael Jordan — now retired and also his own brand — passed the keys to the Air Jordan legacy by inking another 19-year-old national champion, Carmelo Anthony, to a shoe deal worth a reported $40 million.

In regard to basketball, Nike was as on top as it had ever been. By bringing in LeBron, the company defeated Reebok’s race to sign the same star. In securing Kobe, it took top talent from Adidas.

But the greatest get of all? Nike bought Converse in 2003 for $315 million.

To this day, the Swoosh’s ownership of the Chevron means eating off sales tied to the Converse Pro Leather, Weapon, and more. Having parted ways with Converse in ’94, Magic didn’t eat off the sale but did learn from his mistakes.

In the early ’00s, Magic 32 launched as Johnson’s independent entry into sportswear.

The business name, first a music venture that saw Johnson sign R&B singer Avant and promote Janet Jackson’s Velvet Rope Tour, morphed into his own line of sneakers and a failed sporting goods store that cost him $200,000.

All these losses and lessons may seem costly when it comes to Magic’s famous footsteps.

However, consider this: In 2023, Magic Johnson himself is worth almost twice what Nike paid to acquire Converse in 2003. While most moguls born from basketball have used success in the shoe business to grow and get rich, Magic was able to take adversity in said space and grow in others.

To this day, he’s used his experiences — both good and bad — to inspire and educate others, all while keeping a grind and optimism that makes Magic, well, simply Magic.

“Can you imagine? Forty-five years, $5 billion is what that stock would be worth today,” Magic told All the Smoke. “I didn’t know nothing about it and my family didn’t come from money. When you don’t come from money? I didn’t even know what stock was at that time.”

From movie theaters to Starbucks, team leadership to team ownership, Magic knows a lot about stocks now.

He has the capital and calluses to prove it.

Read More:

- Microsoft Gambles Big With $1.5B Investment in Foreign AI Firm

- The Jordan Luka 3: A Design Driven by Dončić

- Andre Ward is Still Writing His Story

- Chet Holmgren Has Been Studying the Sneaker Game for Years

- Learning on the Fly: How Chet Holmgren is Spreading His Wings in OKC