Ethereum’s price drop is causing a major crypto crash after the SEC signaled potential new regulations on the markets for blockchain-powered digital assets.

Since the completion of the Ethereum merge last week, crypto asset prices have been crashing once again. Most notably, Bitcoin and Ethereum prices continue to plummet.

This cryptocurrency crash doesn’t mean the Ethereum merge failed, as its blockchain network’s upgrade to the “proof-of-stake” method was mainly geared toward technical and environmental improvements — these can be achieved regardless of ETH’s market price.

Following the merge, Securities and Exchange Commission Chairmain Gary Gensler said he believes most cryptocurrencies are effectively investment securities and should therefore be regulated by the SEC. Gensler made these comments at a Senate Banking Committee hearing last week, where he also proposed cryptocurrencies be required to stand the “Howey Test” — originated in a 1946 Supreme Court case, it’s meant to determine which types of transactions qualify as investment contracts that would be subject to US securities laws, Investopedia notes.

Speaking of government attention, President Joe Biden’s administration has been working on recommendations and guidelines to ensure the sustainable development and responsible regulation of digital assets in the long term — the White House recently shared its first proposed framework for accomplishing that goal.

Essentially, the merge is indirectly affecting crypto prices because it sparked federal government attention. With that in mind, we’ve got some more key details you need to know in order to understand what’s going on in the cryptocurrency market here and now.

Crypto Market Stats

Ethereum, priced at $1,354, is down approximately 1.5% for the day at the time of this writing (Sept. 20). While the cryptocurrency has modestly rebounded since its low point on Sept. 19, ETH was sitting at about $1,600 before the merge, which makes the current price down about 15-16% by comparison.

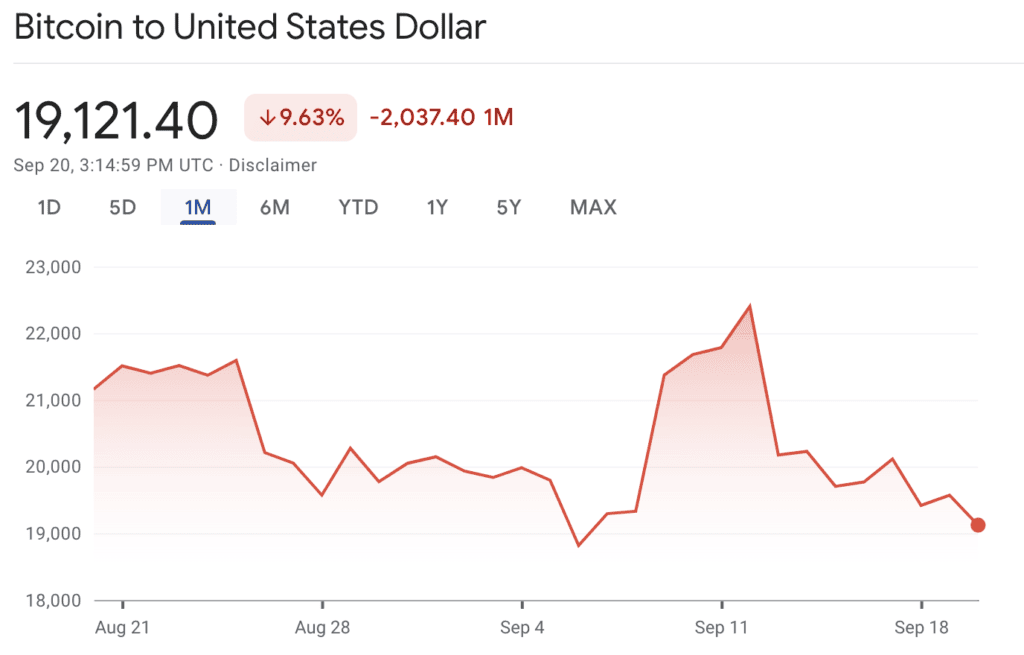

Bitcoin has dipped below $20,000 again and is currently priced at $19,100; BTC was priced at roughly $22,330 days before the merge. The currency’s price drop comes at an interesting time, as there is more Bitcoin mining happening now than ever before. Notably, Bitcoin still uses the “proof-of-work” method of crypto mining, the consensus mechanism for the industry — and one that the Ethereum blockchain just put in its rear view.

The difficulty of mining Bitcoin will grow increasingly difficult as its blockchain inches closer to the infamous “halving” event set for May 2024.

More prices for what some cryptocurrencies are trading for today according to CoinMarketCap data:

- Cardano is down 11% to $0.46 compared to its price a week ago. This price is also down roughly $0.80 compared to its value in March.

- Solana’s price is $32.78, which is down 13%.

- Polygon is down 18% to $0.77.

Cardano, Solana, and Polygon all use the proof-of-stake consensus mechanism.

More Theories

- Coinglass data shows that over 121,100 traders liquidated nearly $410 million in crypto assets in a 24-hour period in the wake of the merge.

- If ETH becomes a security, regulations would soon follow, which could be why crypto investors are selling off their investments in the cryptocurrency before any of that becomes a reality.

- Since the merge, ETH has lost more than 20% of its value, which may be another reason why investors are rushing to sell. The major sell-off began before the merge was complete as investors were doubtful about its success.

- We spoke too soon in March when we said the “crypto winter” was ending. The market was doing much better earlier this year than it is now.