From DraftKings to Flutter to Penn, publicly traded gaming companies have had a seriously rough November. Let’s talk about what’s going on here.

Those who invested in sports gambling companies when the pandemic began made a killing… if they sold at the correct time. Anyone still holding those stocks today, meanwhile, has seen their gains reduced significantly.

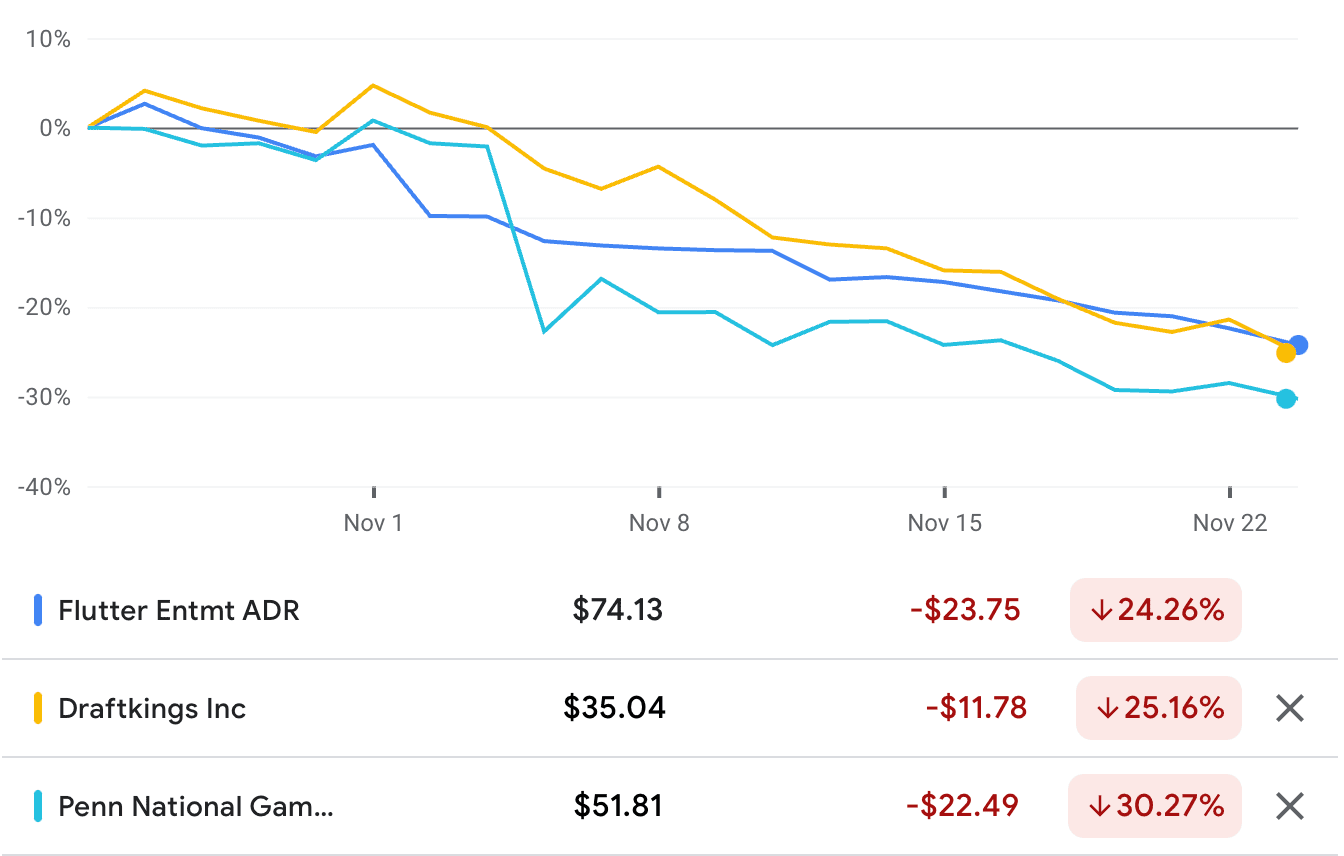

The three biggest publicly traded sports betting stocks have been getting crushed this month:

- Flutter Entertainment ($PDYPY), the parent company of FanDuel, was trading at 100.48 on Oct. 26 but is down more than 25% since then

- Penn National Gaming ($PENN), parent company of Barstool Sports, is down 31% over the past month

- DraftKings ($DKNG) is down nearly 26% over the same period.

So, what on earth is going on?

As Scott Cooley, president of CoolMedia PR, which has worked with several offshore and domestic sportsbooks since PASPA (Professional and Amateur Sports Protection Act) was overturned in May of 2018, explained to Boardroom:

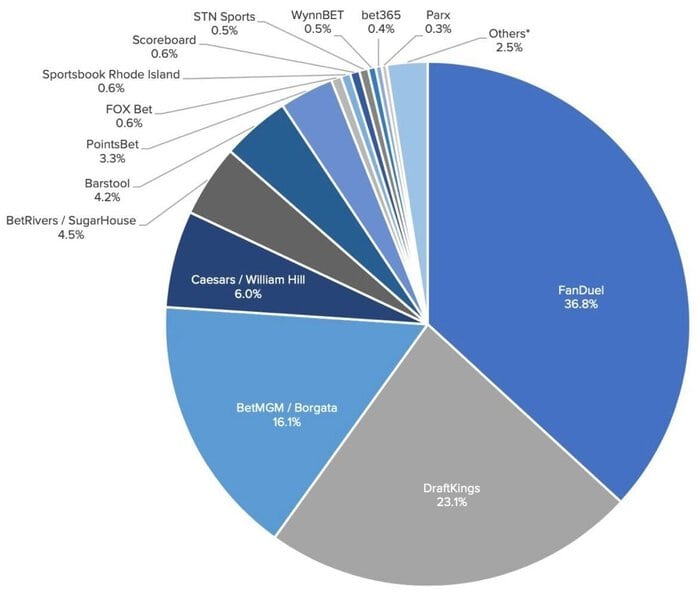

“Everybody is trying to get a piece of the sports gambling pie, but MGM, FanDuel, DraftKings, and Barstool are attaining most of the market share. But at the same time, the cost per acquisition is up to $1,500 to $2,000 per player, and if a lot of those players are only $10 or $20 gamblers, the math just does not make sense. So those stock numbers were not sustainable under current market conditions, and as a result, we may be at a post-plateau point, and I think we may see some of these massive marketing campaigns dialed back in the near future.”

Anyone who watches sports on television or listens on the radio on a regular basis has been inundated with commercials from sports gambling companies — what the market is starting to realize is that there are a finite number of people willing to gamble their money on a regular basis, and a majority of them have already signed up in states where gambling is already legal or is about to become legal.

As a practical matter, that means more and more marketing money is being spent to sign up fewer and fewer players, and what we are seeing on Wall Street is a realization that many of these companies became overvalued in the time since the pandemic began in March of 2020.

Back then, Penn National Gaming was trading at $7.89 per share. Less than a year later, it was at $130.47 on March 8 of this year but since then has dropped significantly, including nearly 10% in the past five days alone.

Caesars Entertainment was trading in the $94 per share range today after hitting a high of $119.49 on Oct. 1.

MGM Resorts International was trading in the $43 range today after being above $50 per share as recently as Nov. 5.

As they say, predicting the market is extraordinarily tricky. But this is one that insiders have seen coming, especially when Q3 earnings reports came in lower than expected. The chart below depicts the percentage split of Gross Gaming Revenue, providing a terrific breakdown of which companies are succeeding in this space (in terms of driving actual numbers) and which are coming up short.

(And as always, high revenues can absolutely be offset by high advertising and marketing costs.)

Additionally, American casino company stocks have fallen from their summer highs because of worsening pandemic conditions in America and in the Asian gaming capital of Macau. Where this freefall ends is anyone’s best guess, but gambling activitytypically starts to come back on Thanksgiving when three highly-watched NFL games are on, and again in December when college basketball gets to full throttle, college football hits conference championship and bowl season, and the NFL playoff hunt boils over.

Of course, household budgetary concerns (this much for gasoline, that much for food, this much for holiday gifts, etc.) can reduce the amount of discretionary income that folks can devote to sports betting. That’s why the gaming companies are trying their hardest to market to gamblers in their 20s and 30s — many of whom do not yet have family cost commitments and long-term housing cost commitments — who have the ability to spend a disproportionate amount of their earnings on what could basically be described as frivolities, with gambling among those potential expenditures.

But ultimately, where is the floor for these stocks?

Hey, if we all knew that, we wouldn’t even have to consider gambling on sports, would we?