The photo-matched Nike Air Zoom Generation will be available for fractional investment starting Sunday, Dec. 12

With a $90 million Nike contract inked even before the 2003 NBA Draft, the anticipation some six months later for LeBron James’ debut signature shoe made for one of the most hyped sneaker unveils in league history.

Throughout the course of his Hall of Fame career, both sneakerheads and collectors have often gone back to the beginning, pointing to the Air Zoom Generation as one of James’ greatest silhouettes in his two-decade long signature series.

Now, fans will have a chance to take part in fractional ownership of an original AZG, as a size 16 game-worn pair photo-matched to three games during LeBron’s earliest days in the NBA will be offered in an IPO this Sunday, Dec. 12 at 9 p.m. EST on the Collectable App.

Valued at $450,000, a total of 90,000 shares will be made available to app members at $5 per share.

“I really haven’t seen a lot of stuff of LeBron’s – especially photo-matched pairs of rookie sneakers,” said Ezra Levine, Collectable’s CEO.

Throughout the course of his 2003-04 Rookie of the Year season, James wore the black and white pair of Zoom Generations with varsity crimson accents more than 30 times, mostly on the road. This was long before the league would ditch its footwear color restrictions in 2018, during a time in which players often operated with just a handful of tame team colorways during the regular season.

James wore the mostly white and varsity maroon edition in 14 games towards the end of that season, the “First Game” pair in a batch of 25 games, and surprisingly only wore the white and black lead retail colorway in just a handful of Cavs games.

With design cues inspired by the infamous chrome Hummer H2 that James received on his 18th birthday, the Zoom Generation was the only Nike shoe of his signature series designed by a trio of iconic Nike designers that included Tinker Hatfield, Eric Avar, and Aaron Cooper. Collectively, they had designed nearly every Nike Basketball signature model to that point.

(Photo by Nathaniel S. Butler/NBAE via Getty Images)

This exact pair of black Zoom Generations, photo-matched by leading NBA authenticator Meigray, has been linked to three specific games during the opening months of the 2003-04 season:

- Nov. 28, 2003 at Detroit

- Dec. 2, 2003 at Nuggets

- Dec. 3, 2003 at LA Clippers

Each of the three games holds some layer of historical significance, adding to the value of a rarely available original pair of LeBron’s debut Nike sneaker. They were worn during his first visit to Detroit, who would eventually become one of the Cavaliers’ primary Eastern Conference foes during his first Cleveland run.

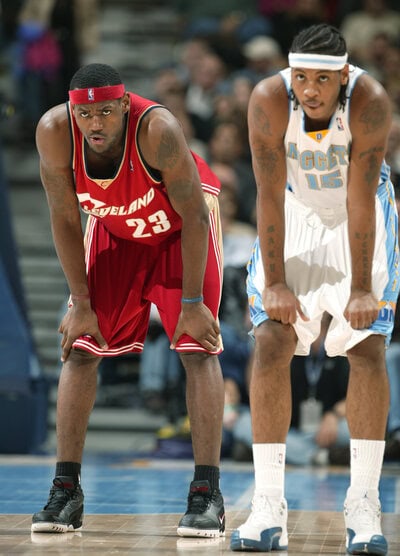

While in Denver, James faced off against fellow rookie and longtime friend Carmelo Anthony. The following night, he took the Staples Center floor for the very first time in his career, where he now calls home.

As the collectible market and fractional investment format of offerings has continued to generate interest and excitement in the past year, as you’d imagine, James’ items have been amongst the most coveted in the space.

“We’ve seen LeBron’s popularity [rise] in the collectible space as it relates to his cards,” added Levine. “His modern cards sell for millions, and one sold for over $5 Million recently, that was numbered to 23.”

In the sneaker space, James’ earliest game-worn pairs have rarely been made available, with collectors hoarding them and James also known to hang onto pairs. There’s a massive difference between finding a game-issued player exclusive edition, versus a true game-worn pair like this.

According to Levine, Collectable acquired the game-worn Zoom Generations from the same private collector that owned a pair of yellow and royal blue Nike Hyperfuses worn by Stephen Curry during the final season of his initial Nike shoe deal.

After originally being offered to Collectable app members for IPO, the Curry pair received a private sale offer of $110,000 and was ultimately sold.

That earned members a quick return on their initial investment.

“There’s two primary ways to make money [with fractional investments on Collectable],” said Levine. “One is buyout offers from a private sale, and the other is through the secondary market.”

Once shares that are offered for IPO become “fully funded,” there is typically a 60-day hold placed on those shares, which can then be offered by members at their discretion to other users on the app’s secondary market. High post-launch demand can increase the value and share price, and thereby increase the return on a member’s initial investment into that item.

In the case of the Curry Hyperfuses, when a private sale offer is made that is at least 20% over the IPO price, Collectable will present the offer to investors and determine if it’s worth selling the product for a full buyout – with investors earning a return based on the split difference of the new sale price. Of the 185 assets on the platform in the last year, Collectable has executed around 30 buyouts.

For now, the game-worn pair of Zoom Generations that LeBron laced up for three regular season games as a rookie will be made available for IPO this weekend, with Collectable hopeful that the value and potential return on the fractional investment will be yet another winning asset for its members.

“The industry has seen explosive growth. The collectibles industry is at the intersection of passion and profits,” added Levine. “You’ve got collectors who collect assets for the pride of ownership, but you also have investors that’re looking at the space as legitimate alternative assets. The industry of collectibles has become mainstream, cool and relevant in ways that it has never been before.”