The Hall of Famer knows what it’s like to have to learn about financial responsibility on the fly. His partnership with Invesco QQQ helps young earners navigate this complicated world.

Grant Hill remembers being 21 years old. Mere months after he could legally drink, Hill was suddenly an NBA player with a multi-million dollar contract and a laundry list of major expectations in the quest to turn around a struggling Detroit Pistons franchise in 1994.

Suddenly with more money than he knew what to do with — the former Duke Blue Devil was set to make $2.75 million as a rookie — Hill didn’t have the luxury of time to figure out personal responsibility on a scale he had never had to consider.

“As a student-athlete, you never really have a job,” Hill told Boardroom. “The first job that you have, all of a sudden, you’re in a situation where you’re making extreme amounts of money. And so, in terms of investing, in terms of compound interest, in terms of taxes and what that means, in terms of even budgeting, I was oblivious to.”

And Hill wasn’t alone. He knows of the athletes, in basketball and beyond, who sign mammoth contracts at a young age, burn through it, and are left with nothing. Through his own success, struggles, and learning opportunities, he’s become someone who knows a thing or two about how to maximize your money.

And it’s knowledge that Hill is eager to pass along.

Through almost two decades in the NBA, Hill made around $142 million in salary, not including endorsements. He had sneaker deals, most notably with Fila, and signed a lifetime contract with the brand in 2018. He’s also been the face of iconic campaigns with Sprite and McDonalds. Now, as a former player, Hill is a broadcaster for NBA TV and Turner Sports — and since 2015, he has been a co-owner of the Atlanta Hawks.

But to get there, the seven-time All-Star had to surround himself with the right people. As a teenager, Duke head coach Mike Krzyzewski was one of them.

“I learned about leadership. I learned about pursuing excellence and managing failure, and all of the qualities and characteristics that equate with success,” Hill said of the soon-to-be-retired Coach K. “So although it’s almost 30 years ago, it feels like it was yesterday, and those experiences are really embedded in me and are part of my DNA.”

Three decades later, Hill is trying to pay it forward, knowing not everybody benefits from having a role model and mentor like Coach K.

This probably isn’t the first you’re seeing of Hill working with Invesco QQQ. This is his second year with QQQ Hoops and this year is serving as a guide in a digital experience meant to demonstrate to users the power of investing. The experience will go live on March 11.

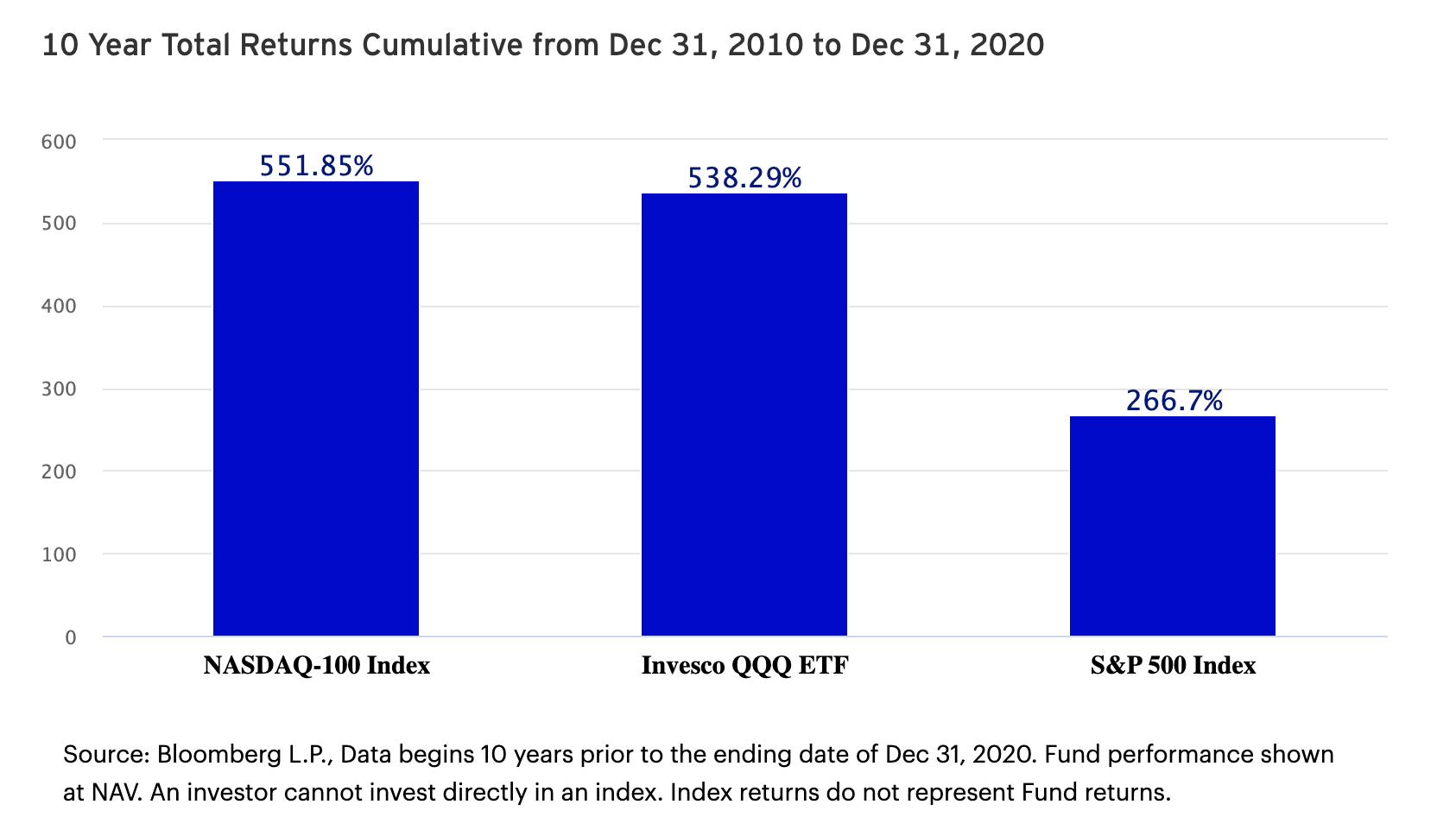

The experience is simple enough to navigate. Once the user starts the game, he or she could welcome Hill into their digital world, where he gives a quick rundown of what’s about to happen. First, the user starts with $10,000 then must make shots using a digital ball and hoop that appears on-screen to earn more money within an allotted period of time. When time is up, Invesco shows how much money the user has earned — and how much that would be worth if invested over 10 years in Invesco QQQ, a large-cap ETF that tracks the NASDAQ 100.

The end-game presentation is straightforward, and while you can find similar comparisons elsewhere on the Internet, it gets the most important point across: learning how to manage your money can pay off in spades down the road.

Sometimes, it takes Hall of Famer dropping into your living room via your phone screen to get the point across, and Hill is happy to be the face of this effort.

“The window of opportunity is short,” Hill said of athletes just starting to earn money in sports. “You have to start thinking long-term, which is hard to do when you’re in your early twenties.”

There is an advantage, Hill said, that athletes have over other young people who might come into money quickly.

“The values that are required to be in a position to be compensated as an athlete: disciplines sacrifice, goal-setting,” he said. “All of those things, to me, are transferable. I think you can apply that as it relates to being financially literate.”

They just might need a push in the right direction.