With the legendary QB announcing his NFL retirement, is it time to invest in his trading cards? The answer isn’t so simple.

Regardless of whether you’re an avid sports trading card collector with decades of experience or a new wave investor looking to take advantage of one of the hottest asset classes of our generation, there is one thing everyone in the industry has in common:

None of us ever experienced a trading card “supercycle” before. And now that Drew Brees’ retirement has brought renewed attention to his rarest cards, it’s time to figure out what that means for the industry.

In August 1938, accountant and stock market researcher Ralph Nelson Elliott published his bookThe Wave Principle, which argues that financial markets follow predictable patterns that can be measured and forecast. One concept he popularized was that of the supercycle.

He defined this as the small generation of “waves” (market movements) that together make up the Grand Supercycle, the longest and most aggressive period of growth for a given financial market.

We promise that there’s a connection to Drew Brees here. Let us explain.

As anyone who has spent the past 12-18 months observing the rapid appreciation of sports trading card values can attest, it has been legitimately aggressive, with huge numbers of cards increasing in price by hundreds and even thousands of percent — rookie cards especially.

Most interestingly in a supercycle, however, is that much of the analysis of how a market has worked in the past becomes irrelevant.

Instead, investors that can best make sense of current market movement in a supercycle are in the best position to succeed. This is what we’ve seen in recent months in the cryptocurrency space, as even late Bitcoin adopters are making serious gains through an aggressive approach based on real-time trends.

At this point, you are surely asking out loud what any of this has to do with Drew Brees rookie cards.

The short answer? Maybe everything.

Many grew incredible wealth by observing Bitcoin’s supercycle progress and applying its patterns to alternative cryptocurrencies (otherwise known as “alts”). There is likewise an opportunity to analyze Brees’ rookie card market for future insight now that he has officially become the first high-profile star athlete to retire during this sports trading card supercycle.

This way, the next time an event such as this occurs again, whether it’s Tom Brady, Aaron Rodgers, Carmelo Anthony, or LeBron James, smart collectors can apply the lessons learned here to make investment plays that should have unbalanced (in a good way!) risk/return profiles.

Let’s do that right now by taking a look at Drew Brees’ most popular rookie card: the 2011 Topps Base PSA 10 pictured above.

The first thing to note here is that even with about a dozen listings available on eBay, there has yet to be a mad rush on these cards in the early period after Sunday’s retirement announcement. In fact, only a single card exchanged hands in the first 48 hours.

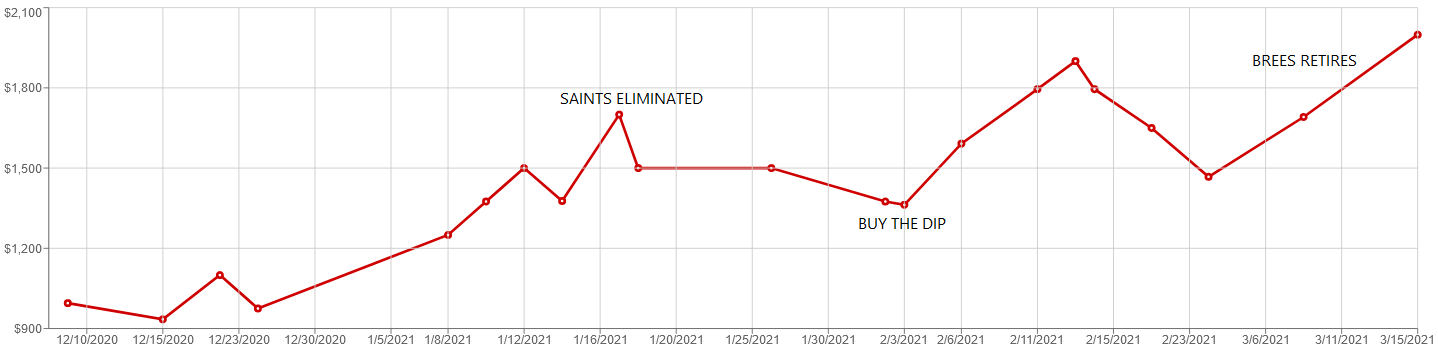

Looking at the above chart, we can see that the Topps Base bottomed out in December before going on a steep run-up during the final weeks of the NFL season, topping out on the exact day Brees New Orleans Saints were eliminated by the eventual Super Bowl champion Tampa Bay Buccaneers in the playoffs.

This is where things get interesting. While regular cycles would likely see eliminated players’ cards drop in value by some 30-40% over the coming months, Brees’ Topps rookie didn’t even experience a 20% decrease before surging upwards by more than 45% in the six weeks leading up to his retirement announcement.

So, although this is just a hypothesis at this point and should be taken with a grain of salt, it’s looking like the shrewdest investors used the post-playoff dip to accumulate ahead of Brees’ expected retirement, and may now be holding for the long-term.

Alternatively, as the on-market supply diminishes, some may be in the process of leveraging the increased attention on Brees to cash out at a profit here and now.

Of course, with relatively low sample sizes, making overly grand generalizations is difficult. But in a game often filled with imperfect information, operating based on some informed hypotheses about this latest supercycle can give trading card investors an edge.