Now trading as “Meta,” Facebook’s stock has been a mixed bag since the dog days of summer — but compared to Twitter, $FB’s been an absolute picnic. So, what’s happening here?

Do we regulate them, or do they regulate us? Such is the predicament of living in a world in which it is increasingly difficult to steer clear of Apple, Amazon, Microsoft, Facebook, Twitter, and Google. Even if you made a concerted effort to try.

Your conventional wisdom might be, then, that buying stock in a ubiquitous firm in the global pantheon of big tech would be a foolproof proposition.

You’d be wrong.

Take as an example the situation of the two most well-known social networks on Earth: Facebook (rebranded at the corporate level as “Meta”) and Twitter. Over the past year, one of them is outperforming key indexes — and the other is in an unavoidable rut.

Let’s talk about what’s going on here.

Meta (Facebook): $FB

In October of last year — do you still feel weird calling 2021 “last year?” — Facebook announced plans to rebrand its umbrella organization as “Meta.” It’s far from unprecedented in big tech; it wasn’t all that long ago that Google did something similar via Alphabet.

But this particular move wasn’t just done with the bottom line in mind. Rather, it was absolutely dripping with intent.

In this brave new world of Web3, Facebook wants to be the single biggest player in the ever-expanding metaverse.

Last 12 months: ↑ 24.03%

Last 6 months: ↓ 5.05%

Last month: ↑ 3.15%

2022 year to date: ↓ 1.69%

Notably, $FB stock didn’t experience any sustained bump following the Meta news, but its losses at the back end of 2021 are generally in line with the overall trend of the NASDAQ 100. On Oct. 28 — the date of Facebook’s annual Connect conference — the company’s stock actually hit its lowest point since May. Since then, $FB is up over 8.6%.

That’s not too shabby. Not too shabby at all.

The same cannot be said for Twitter.

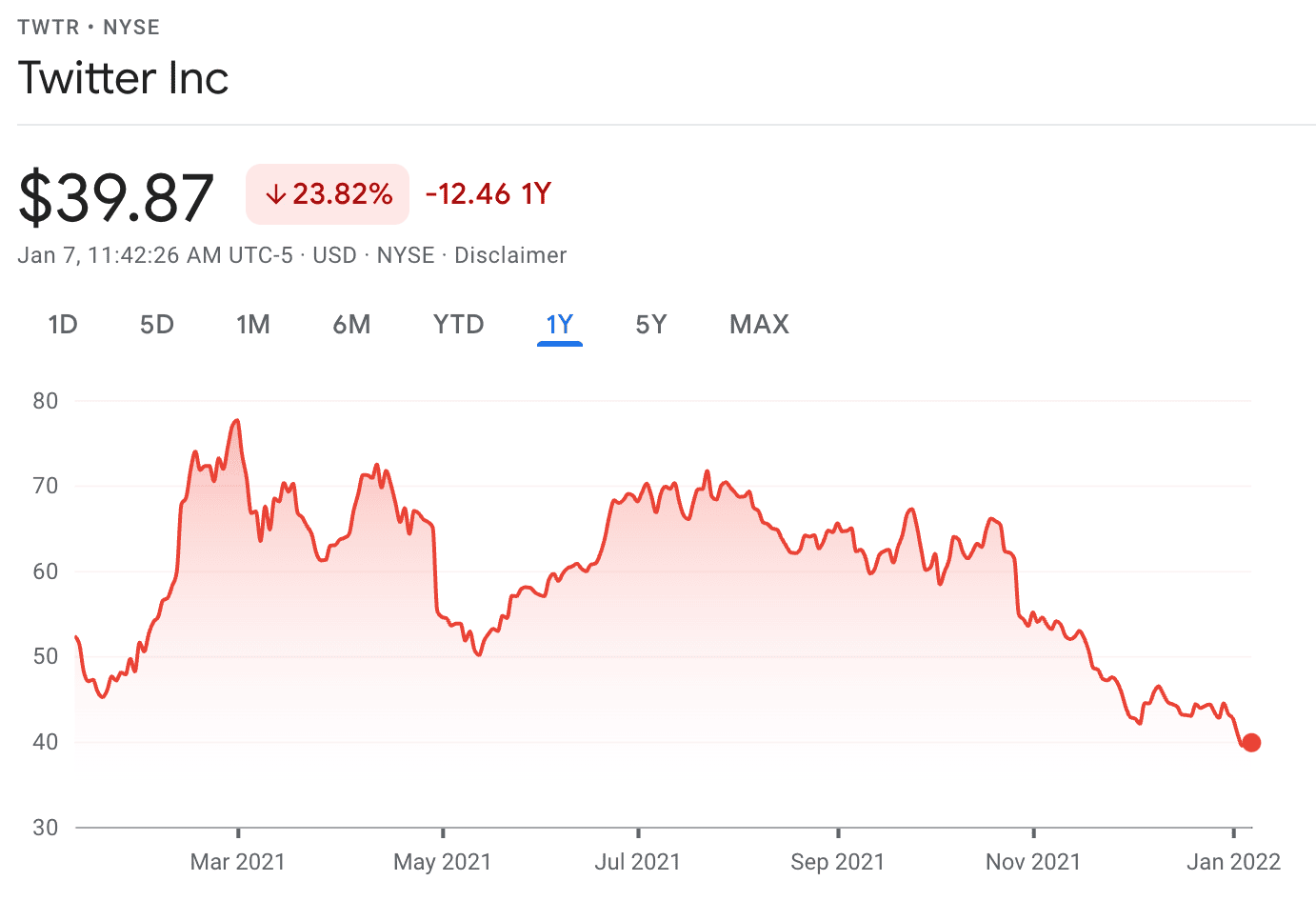

Twitter: $TWTR

What’s going on with that little blue bird?

While Twitter’s role in content discovery and rapid-response communication across our various overlapping media bubbles won’t just go away, a few things have happened in and around the company in the last few months that investors cannot afford to ignore:

- Nov. 29, 2021: Co-founder and CEO Jack Dorsey announces his resignation, effective immediately; Chief Technology Officer Parag Agrawal takes over as CEO.

- Dec. 2, 2021: Twitter stock ($TWTR) reaches its lowest close of 2021: $42.07 per share (compared to a calendar year high of $80.75)

- Dec. 22, 2021: Venture capitalist Marc Andreessen of Andreessen Horowitz blocks Dorsey on Twitter following a string of tweets criticizing VC’s role in Web3

- Jan. 4, 2022: Ark Investment Management, which owns upwards of 15 million shares in Twitter across three ETFs it manages, sells a reported 2.35 million shares of $TWTR in the first two trading days of 2022, worth just under $97 million

Last 12 months:↓ 23.82%

Last 6 months: ↓ 41.93%

Last month: ↓ 10.17%

2022 year to date: ↓ 6.35%

As a whole over the last 12 months:

- The NASDAQ Composite is up over 13%

- The NYSE Composite — $TWTR is listed on the New York Stock Exchange — is up 14.7%

- The S&P 500 is up 22.29%

For $TWTR to be down almost 24% from the previous year is absolutely startling.

And the stark contrast in trajectory specifically between Twitter and Facebook got us thinking: What’s going on with the rest of the world of big tech?

To answer this question, we dove into Apple, Amazon, Google, and Microsoft to see if the big-picture view of the bleeding edge looks more like Meta’s promising outlook or the bluebird’s market melancholy.

Apple: $AAPL

Whose last 12 months have outpaced Facebook AND the eternally rock-solid S&P 500?

The ol’ Forbidden Fruit. You know the one.

Last 12 months:↑ 31.42%

Last 6 months: ↑ 19.07%

Last month: ↑ 0.54%

2022 year to date: ↓ 5.41%

Notably, Apple’s start to 2022 hasn’t been especially nifty — but that’s likely more a reflection of the lukewarm nature of the overall stock market at the moment. Even $AAPL’s last six months have outpaced the growth of the NASDAQ and NYSE Composite indexes’ previous year.

Alphabet (Google): $GOOGL

There’s something in the water over at Google.

Class A shares of Alphabet are up an eye-popping 54.38% in the past year — even with a drop-off of more than 5% to start 2022.

Last 12 months: ↑ 54.38%

Last 6 months: ↑ 8.17%

Last month: ↓ 7.11%

2022 year to date: ↓ 5.66%

Does this mean that now is the time to swoop in for $GOOGL? To be clear, we’re not here to provide buy-or-sell advice — but the trend line simply cannot be ignored.

And it makes you feel even worse about what’s going on with Twitter, Alphabet’s NASDAQ brother.

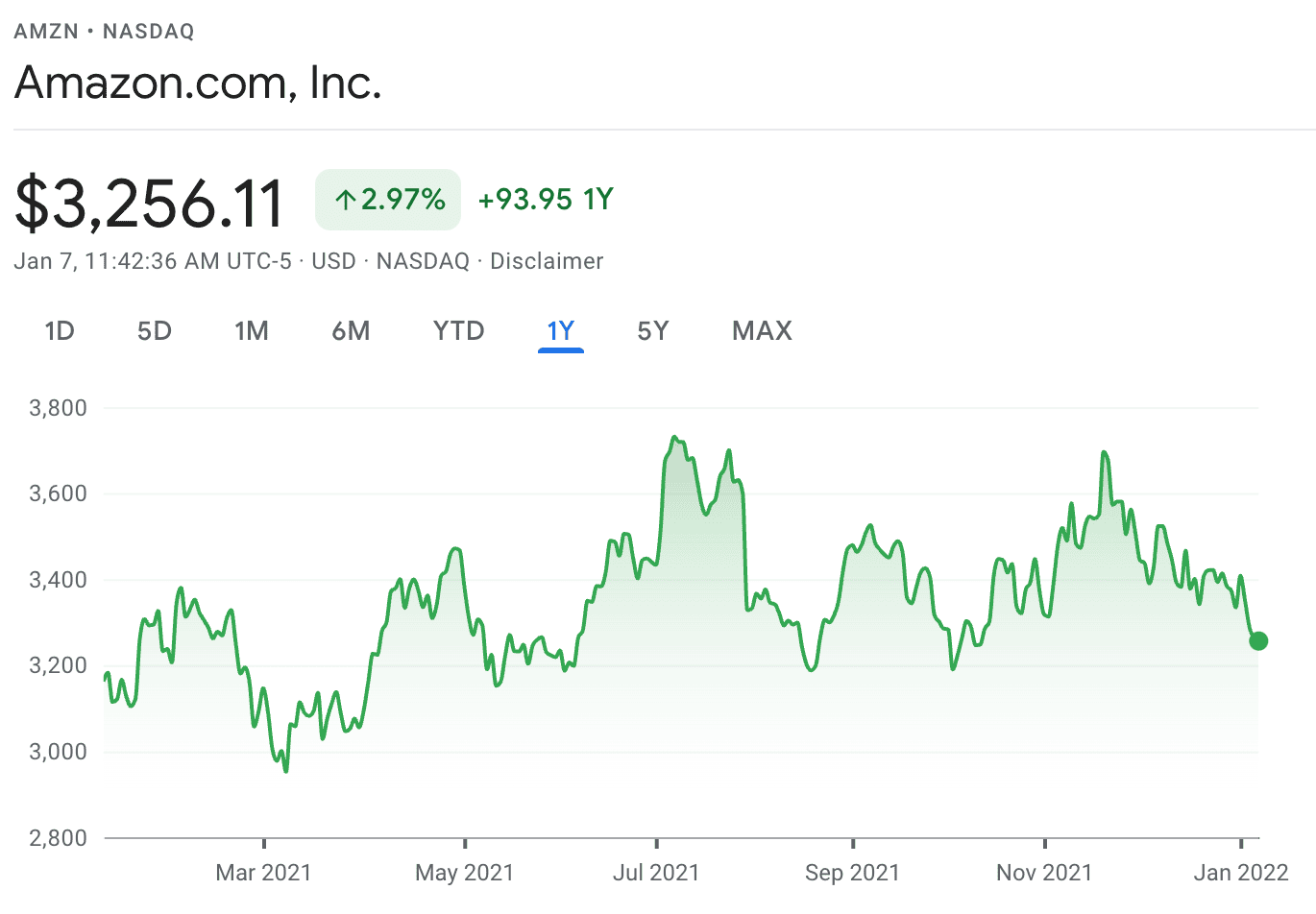

Amazon: $AMZN

Finally, some real peaks and valleys.

As Amazon makes increasingly bigger moves into the media rights and in-house content spaces, it’s not lacking for opportunities to make headlines and drive buzz — but in the last six months in particular, they haven’t covered themselves in glory.

Last 12 months: ↑ 2.97%

Last 6 months: ↓ 11.93%

Last month: ↓ 7.64%

2022 year to date: ↓ 4.47%

A silver lining to take with you? $AMZN’s drop-off to start 2022 is smaller than those of Twitter, Apple, and Alphabet.

Microsoft: $MSFT

Old reliable, right? Depending on your age, there’s either a modest or extremely high chance that Microsoft is the most familiar name on this list.

And they closed out 2021 particularly strongly.

Last 12 months: ↑ 43.23%

Last 6 months: ↑ 13.20%

Last month: ↓ 6.25%

2022 year to date: ↓ 6.19%

The takeaway here?

It’s Microsoft.

Best not to overthink it.