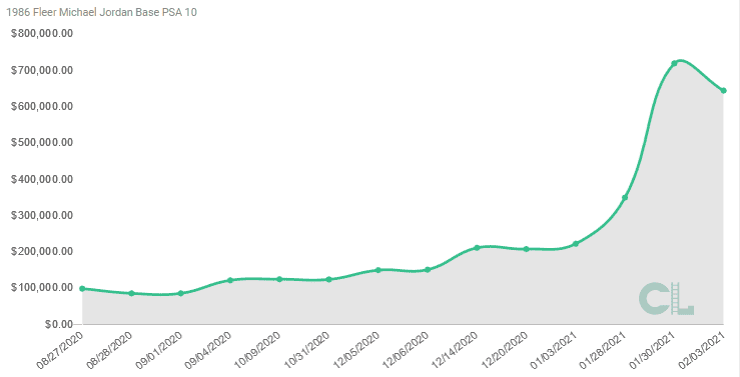

In my last article, I compared the market cap of Jordan’s 86 Fleer both to fellow NBA legends and their S&P 500 equivalents; and what we learned from that exercise was that when it came to rookie-card valuation, nobody even comes close to the undisputed card GOAT. But this left me wondering: how did Jordan’s rookie-card rise (breaking all-time-high prices over and over again in recent months) measure up with one of the most significant climbs in modern history: Bitcoin.

In March of 2020, as COVID-19 began changing our world in so many ways, both Bitcoin and Jordan’s ’86 Fleer PSA 10 were at the lowest price-point they’ve been ever since. At the time, MJ’s rookie-card was trading at about $48,500, and Bitcoin was worth nearly 13x less at approximately $3800. However, fortunately for early(ish) investors, neither would spend very long at these valuations. That’s because, by the end of the year, Jordan’s rookie would set an all-time-high at $211,000, growing by nearly 4.5x in less than 10 months. Whereas Bitcoin price surged to its own all-time-high, closing 2020 at $29,300, an astounding 7.7x post-COVID growth!

But that was nowhere near the end of the line for these two assets, with the last recorded sale of the iconic rookie-card being $645,000 after reaching a high of $720,000 just a few days earlier. Bitcoin is currently trading at nearly $45,000 a few days after hitting its own peak of $48,000 following Elon Musk’s announcement that Tesla had converted $1.5 billion of its cash reserves to the currency.

When it comes to the question of which asset did best over the past year, the answer, for the most part, is neither…or both. That’s because both Bitcoin and the Jordan rookie have grown by a nearly identical 1200% over the past 12 months. Clearly, investors of both assets have had plenty to celebrate. However, with those numbers now in the rear-view mirror, the real debate going forward is which one still has the most room left to appreciate. And while I don’t have the answer to that, if the past 12 months are any indication, 2021 should be a wild ride indeed!