Since last April’s premiere of ESPN’s “The Last Dance,” Michael Jordan’s sports memorabilia has skyrocketed at rates the hobby has never seen.

Eight months ago, a Michael Jordan 1986 Fleer Rookie card could be had for around $40,000; in early February, two PSA 10 Jordan rookie cards sold for $738,00 each.

The sports collectibles market boom is not unique to Jordan, but MJ has been leading the way with his cards, jerseys, and now shoes.

On February 8th, an autographed pair of 1985 Air Jordan 1 shoes sold for $1 million on eBay. The shoe sale came a week after a PSA 7 1997-1998 Upper Deck Game Jerseys Michael Jordan card became the first of his cards to break the seven-figure threshold.

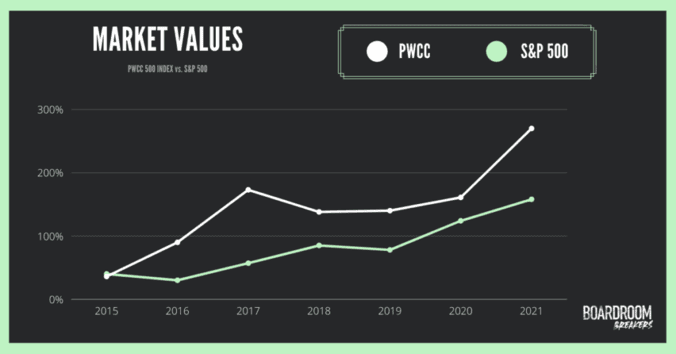

Sports cards have become an alternative investment option, and for many, it has paid big. The PWCC 500 Index, an index that evaluates the trends of the 500 sports cards with the highest average market value, shows that over the last six years, sports cards have even outpaced the S&P 500.

Wall Street doesn’t miss much, and as a result, we’ve seen the sports card industry become securitized in different ways. From sports card hedge funds to companies like Collectable and Rally Rd, which offer shares of blue-chip collectibles through IPO’s, the sports memorabilia market has developed many similarities to the stock market.

If each player’s card or collectible is viewed as stocks in a portfolio, Michael Jordan is like the Amazon of collectibles. With the financial uncertainty that comes with a global pandemic, CNBC notes that investors are wary of inflation signs and are looking for alternative assets to protect their money.

Many of these investors grew up during the 90s sports card crash, which ironically was the sports card version of inflation due to overproduction. When sports card manufacturers incorporated the concept of serialization or numbering cards, scarcity returned to the hobby.

With the cards from the “Junk Era,” an unintentional scarcity was created as grading cards through companies like PSA and Beckett became increasingly popular.

Cards from the 90s notoriously have centering issues, and now as nearly 30 years have passed, PSA 10’s have given cards from that era increased value, with Michael Jordan’s 1986 Fleer serving as a perfect example.

The ever-growing and adapting nature of the sports collectible industry allows the imagination to run as to how much the hobby can continue to grow.