The $BAD ETF, which tracks the alcohol, cannabis, gambling, and pharmaceutical industries, debuted this week on the NYSE.

As of this week at the New York Stock Exchange, it’s good to be BAD — at least as long as the markets are trending in the right direction.

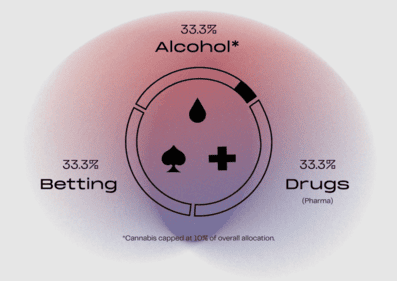

There’s a new exchange-traded fund (ETF) that debuted on the NYSE on Dec. 22, and it provides a way to invest in some of the economy’s leading vices, from alcohol to gambling to cannabis. Literally listed under stock symbol $BAD — meant to represent Betting, Alcohol, and Drugs — the new large-cap fund launched by “The BAD Investment Company” is equally weighted with stocks split between three industries:

- Betting and casino gaming (33.3%)

- Alcohol and cannabis (33.3%, with cannabis specifically capped at 10%)

- Pharmaceuticals and biotech (33.3%)

To hear them tell it, they’re on a mission to Build Back Badder.

As BAD Investment Company Co-founder and President Tommy Mancuso said in an official release:

“With the proliferation of whitewashed ESG products and market sub-segments like sports betting and cannabis becoming more widely accepted socially and legally, we saw an opportunity to fill what we perceived as a gap in the marketplace. We came to that conclusion primarily by listening and watching this newly energized retail crowd over the past year. We believe they want investment products rooted in transparency and quality that they may also be able to understand and relate to as consumers whether that is in health, wellbeing, or entertainment.”

At launch on Dec. 22, the $BAD ETF opened at $15.03 per share. When markets closed on Dec. 23, it was trading at $15.22 per share, an increase of 1.26%.

Selected Stocks Among $BAD’s Holdings

- $ABBV: Abbvie, Inc. (weighted 1.61%)

- $ABEV: Ambev SA (2.42%)

- $ACB: Aurora Cannabis Inc. (2.31%)

- $ACEL: Accel Entertainment Inc. (1.68%)

- $AMGN: Amgen Inc. (1.59%)

- $AZN: Astrazeneca Plc (1.60%)

- $BALY: Ballys Corporation (1.64%)

- $BF.B: Brown Forman Corp., Class B (2.48%)

- $BGNE: Beigene Ltd. (1.39%)

- $BIIB: Biogen Inc. (1.56%)

- $BMY: Bristol-Myers Squibb Co. (1.61%)

- $BNTX: Biontech SE (1.35%)

- $BUD: Anheuser Busch InBev SA/NV (2.48%)

- $BYD: Boyd Gaming Corp. (1.67%)

- $CCU: Compania Cervecerias Unidas (2.23%)

- $CGC: Canopy Growth Corp. (2.21%)

- $CHDN: Churchill Downs Inc. (1.67%)

- $CRON: Cronos Group Inc. (2.22%)

- $CZR: Caesars Entertainment Inc. (1.71%)

- $DEO: Diageo Plc (2.44%

“I think we should eliminate social stigmas when it comes to investing,” Mancuso said. “If we’re all about getting investment return, [should we] eliminate a company that maybe has a sustainable business model, and may be relatively defensive? We should obviously have the proper regulations put in place, but not neglect them by any means.”

To get closer to that goal, $BAD tracks what’s known as the EQM BAD Index (BADIDX), which follows price fluctuations of a group of companies on US-based exchanges that fall under one of the three aforementioned industries.

“Our mission is to position ourselves in a unique manner compared to most fund management companies. It’s our opinion that we don’t think or dress like the typical ‘suit,’ but are fully capable of harnessing the expertise and insights of Wall Street to provide strategically designed investment products,” Mancuso said.

What is an ETF?

An ETF is an exchange-traded fund, a security that bears many similarities to a mutual fund, but is traded on a stock exchange just like a company’s individual stock. As a result, an ETF’s share price fluctuates throughout the day while markets are open, while a mutual fund’s share price is updated just once per day.

ETFs tend to track specific industries, indexes (like the BADIDX or the S&P 500, for instance), or other sectors or combinations of sectors within the broader economy.

What Are $BAD’s Shareholder Fees?

| Management Fees | 0.75% |

| Distribution and/or Service (12b-1) Fees | (None) |

| Other Expenses* | 0.00% |

| Total Annual Fund Operating Expenses | 0.75% |